August 25, 2022 - Press Release

Kaiser Family Foundation

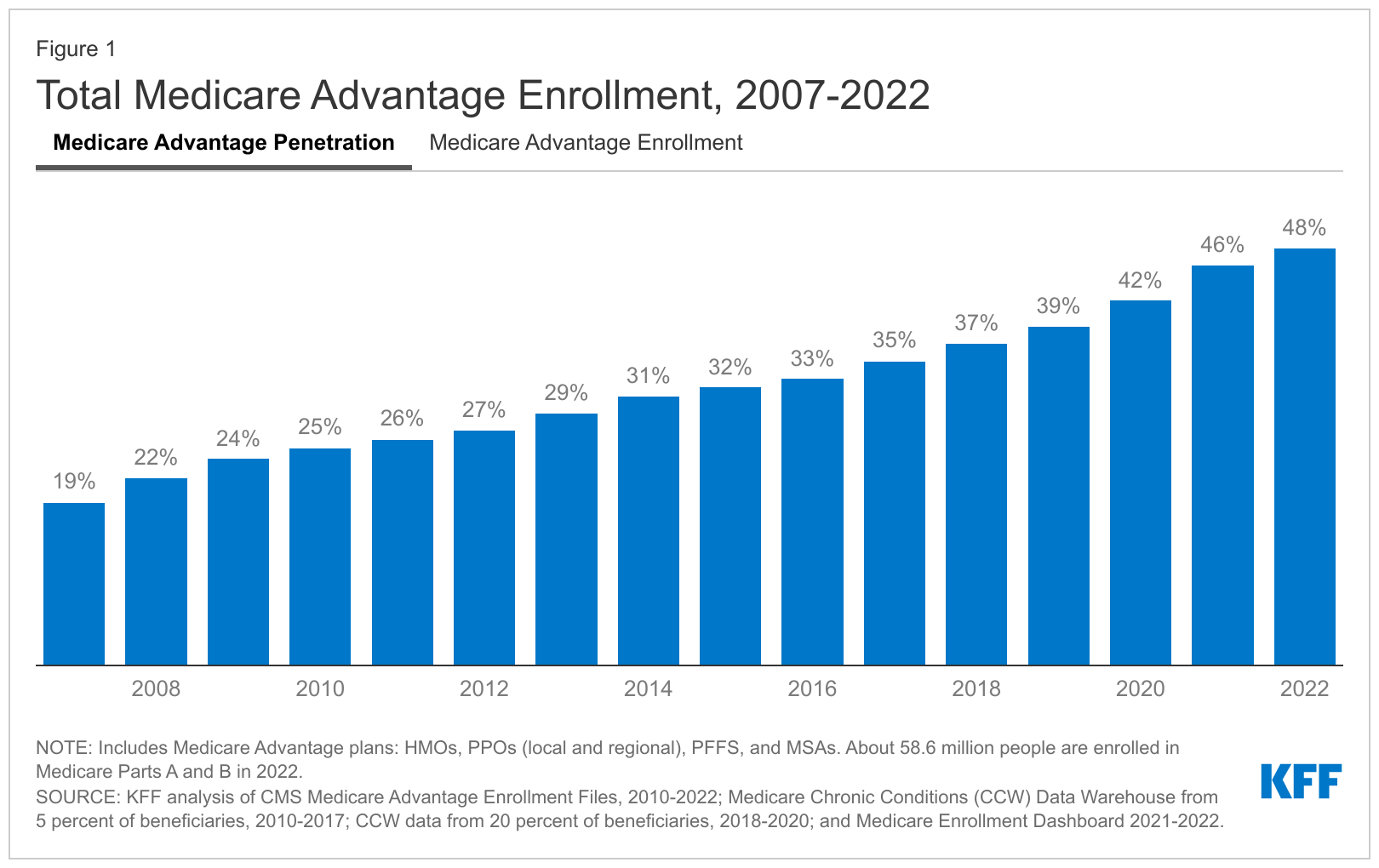

A new KFF analysis finds that nearly half of eligible Medicare beneficiaries ・28.4 million out of 58.6 million Medicare beneficiaries overall ・are now enrolled in Medicare Advantage plans. That represents a more than doubling of the share of the eligible Medicare population enrolled in such plans from 2007 to 2022 (19% to 48%). Enrollment is projected to cross the 50 percent threshold as soon as next year, making Medicare Advantage the predominant way that Medicare beneficiaries with Parts A and B get their coverage and care.

The rise of Medicare Advantage signals the transformation of Medicare to a program in which a majority of people receive benefits by enrolling in plans offered by private health insurance companies.

The new analysis is one of three released today by KFF in which researchers examine various aspects of Medicare Advantage. It provides the latest data on Medicare Advantage enrollment, including the types of plans in which Medicare beneficiaries are enrolled, and how enrollment varies across geographic areas. A companion analysis describes Medicare Advantage premiums, out-of-pocket limits, cost sharing, extra benefits offered, and prior authorization requirements. A third examines trends in bonus payments to Medicare Advantage plans, enrollment in plans in bonus status, and how these measures vary across plan types and firms.

Among other key findings:

Enrollment in private plans is highly concentrated among a small number of firms, with UnitedHealthcare and Humana together accounting for 46 percent of all Medicare Advantage enrollees nationwide. In nearly a third of counties across the U.S., these two firms account for at least 75 percent of Medicare Advantage enrollment.

In 2022, nearly 7 in 10 Medicare Advantage enrollees (69%) are in plans with prescription drug coverage (MA-PDs) that require no premium other than the Medicare Part B premium ($170.10 in 2022).

Nearly all enrollees in individual Medicare Advantage plans open for general enrollment have access to some benefits not covered by traditional Medicare, including eye exams and/or glasses (99%), hearing exams and/or aids (98%), and a fitness benefit (98%).

Virtually all Medicare Advantage enrollees (99%) are in plans that require prior authorization for some services. Prior authorization is most often required for relatively expensive services, such as prescription drugs administered by a physician (Part B drugs; 99%), skilled nursing facility stays (98%), and inpatient hospital stays (acute: 98%; psychiatric: 94%), but it is rarely required for preventive services (6%).

Federal spending on Medicare Advantage bonus payments has increased every year since 2015 and will reach at least $10 billion in 2022. Payments vary across firms, with UnitedHealthcare receiving the largest total payments ($2.8 billion) and Kaiser Permanente receiving the highest payment per enrollee ($521). (KFF is an independent, nonprofit organization that analyzes national health issues and is not affiliated with Kaiser Permanente.) Recently, the Medicare Payment Advisory Commission (MedPAC) and others have raised questions about whether the bonus program includes too many measures, does not adequately account for social risk factors, and may not be a useful indicator of quality for beneficiaries.

The full analyses are available online and include:

(KFF has adjusted its methodology from previous years to calculate the share of eligible Medicare beneficiaries enrolled in Medicare Advantage, meaning they must have both Part A and B coverage. This aligns with how the Medicare Payment Advisory Commission (MedPAC) and others describe this population. The share enrolled in Medicare Advantage would be somewhat smaller using the old method. See the methods section of the analysis.)

For more data and analyses about Medicare Advantage, visit kff.org

CONTACT:

Chris Lee | (202) 654-1403 | clee@kff.org